You then add the tax payment as an expense. You calculate this by looking at your income from the past three months and applying the appropriate tax rate. Paying Taxes As A FreelancerĪs a self-employed person living in the United States, you’ll likely need to pay quarterly tax payments to the IRS. To keep track of mileage, write down the starting and ending odometer readings, the purpose of the trip, and where you went. This can be a notebook, spreadsheet, or a more formal system. Before filing them, note the amount, category, vendor, and date into your expense tracking system. Make a folder for each applicable category and file relevant receipts into the folders each time you spend money. Learn about what categories can be deducted and which ones you can use. There are two parts to tracking expenses: organizing receipts and keeping the totals in one place. You could also record every time you get paid on a Microsoft Excel spreadsheet, tracking who paid you how much for what services. Just make sure to transfer money out of this account before spending it on personal things. This keeps a record of what you’ve been paid.

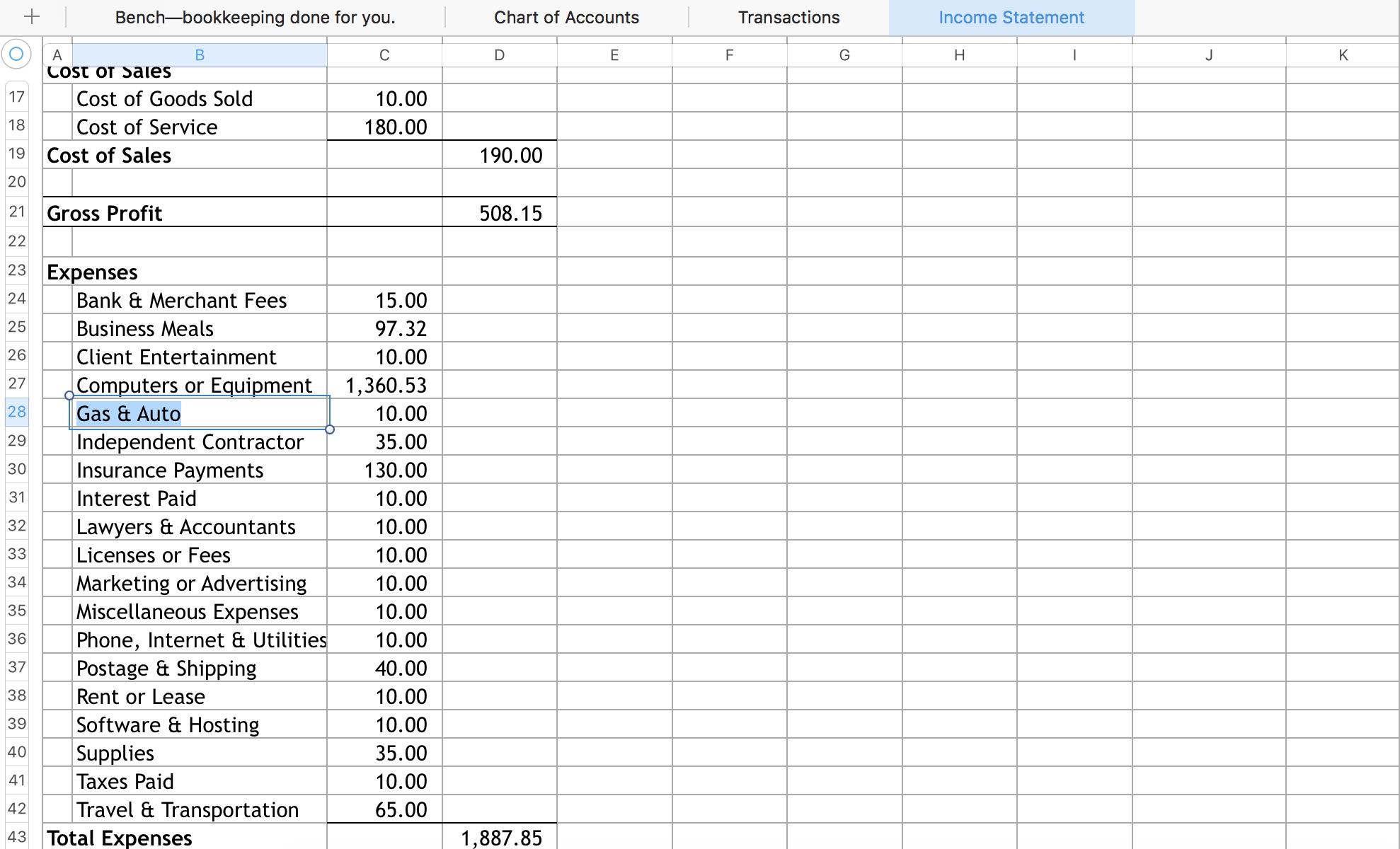

At the very minimum, you could have a separate bank account where you deposit your freelance earnings. To have an accurate record of your income, you need a process and a place to track it. Relying on your calendar of deadlines isn’t always reliable, as some clients don’t pay. You’ll need a way to track all of these payments and keep up with invoices. Most freelancers get their income from many different sources, with some 1099s and some clients that don’t need to issue one. However, this isn’t the best idea, as you won’t have an accurate total for what you pay taxes on if you don’t keep track of your income throughout the year. If you only work with a small group of regular clients that send you a 1099 and don’t plan on having expenses, you could store your 1099s in a file folder for each year, along with the nominal expenses. Depending on how you run your freelance business, you’ll need to record payments from multiple clients, track your car’s mileage to client sites, send invoices, and make quarterly tax payments. Freelancer Accounting 101Īn accounting system simply tracks your income versus your expenses. Fortunately, it’s fairly easy to set up a basic system once you understand what you need. If this is your first time trying to set up an accounting system, or if you’ve outgrown your old accounting system, it can be overwhelming. This means you need a way to track your expenses and mileage, as well as how much money you earn and who hasn’t paid your invoices. If you’re a freelancer, you’re technically your own business.

0 kommentar(er)

0 kommentar(er)